Debt Buyers/Third Party Collection Agencies

A Debt Buyer is a company or individual who purchases accounts with the intent of collecting debts owed.

A Third-Party Collection Agency is a company or individual who specializes in collecting outstanding debts for other businesses or individuals.

A Third-Party Collection Agency is a company or individual who specializes in collecting outstanding debts for other businesses or individuals.

Quick Reference - update April 2021 - Refer to the Debt Buyer/Third Party Collection Agency Reporting details below this table for additional details.

Detailed Reporting Guidelines

- Report the complete name, address, social security number and date of birth for the legally liable consumer(s).

- Report all accounts on a monthly basis, including

2. collection accounts paid in full, and

3. accounts requiring deletion or correction.

- Report paid in full collection accounts before purging the accounts from your internal collection system. Do not re-report paid accounts for more than 3 months.

- Do not report Medical Debt collection accounts (as defined by Creditor Classification Code 02) until they are at least 180 days past the Date of First Delinquency that led to the account being sold or placed for collection.

- Do not delete paid in full collection accounts - Account Status 62.

All parties reporting credit information must comply with the Fair Credit Reporting Act (FCRA), Fair Debt Collection Practices Act (FDCPA), any applicable state laws and regulatory authorities.

1. Consumer Account Number

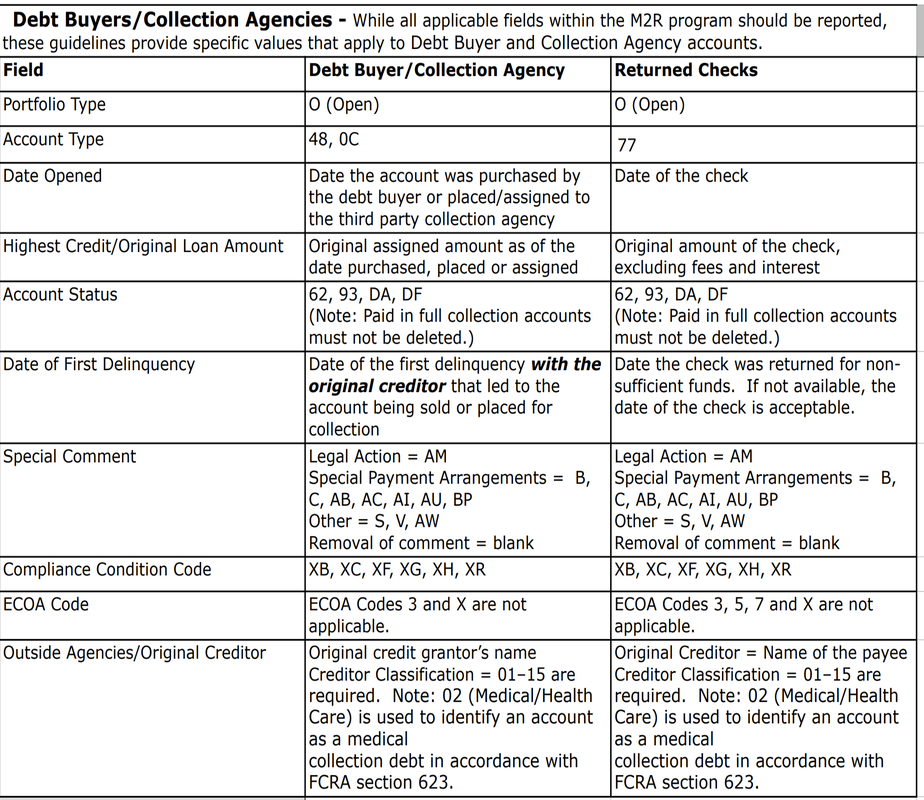

2. Portfolio Type — O (Open)

3. Account Type Codes

4. Date Opened — the date the account was purchased by the debt buyer or placed/assigned to the third party collection agency. When reporting returned checks, provide the date the check was written.

5. Highest Credit or Original Loan Amount — original assigned amount as of the date purchased, placed or assigned. When reporting returned checks, report the original amount of the check, excluding fees and interest.

6. Terms Duration — 001 (this is a default that M2R will set for you)

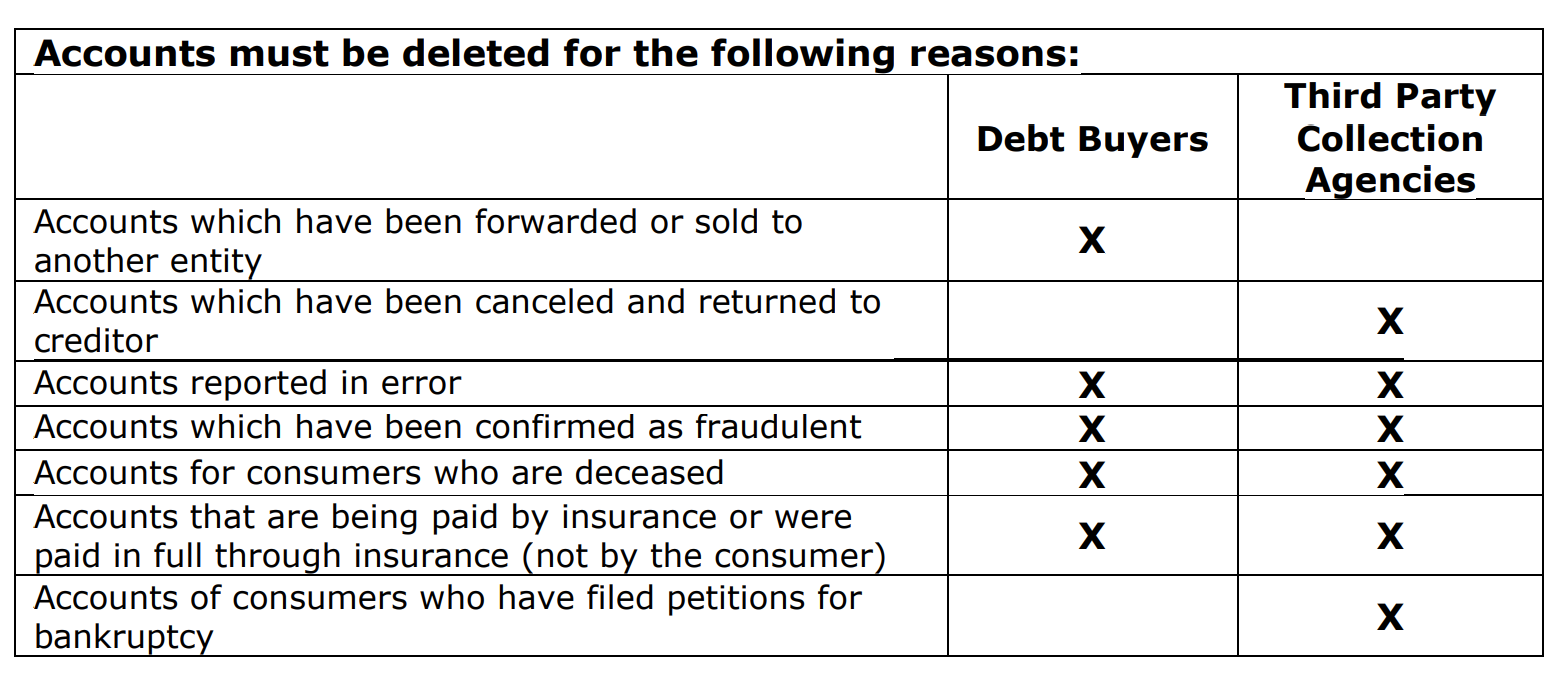

7. Account Status Codes — report only the following:

2. Consumer is deceased. (if no other associated consumer remains responsible for the account)

3. Accounts that are being paid by insurance or were paid in full through insurance (not by the consumer)

4. Debt Buyers must also delete accounts that have been forwarded or sold to another entity.

5. Third Party Collection Agencies must also delete accounts for the following reasons:

— Accounts that have been canceled and returned to the creditor

— Accounts of consumers who have filed petitions for Bankruptcy

6. Do not delete paid in full collection accounts - Account Status 62

- The Date of First Delinquency is used to comply with FCRA sections 605 and 623 (obsolescence period).

- The Creditor Classification 02 Medical/Health Care must be reported in the Original Creditor section under the Outside Agencies tab to identify medical debts to comply with FCRA section 623.

- All parties reporting credit information must respond to consumer inquiries.

1. Consumer Account Number

- Report the individual's complete and unique account number

- If the account number changes, report the new account number by using the "Change" function. See the "Account Information" help section under "What is...." for more information. Note: Notify your consumer reporting agencies the first time this situation occurs.

2. Portfolio Type — O (Open)

3. Account Type Codes

- 48 — Collection Agency/Attorney

- 77 — Returned Check

- 0C — Factoring Company Account (includes Debt Purchasers)

4. Date Opened — the date the account was purchased by the debt buyer or placed/assigned to the third party collection agency. When reporting returned checks, provide the date the check was written.

5. Highest Credit or Original Loan Amount — original assigned amount as of the date purchased, placed or assigned. When reporting returned checks, report the original amount of the check, excluding fees and interest.

6. Terms Duration — 001 (this is a default that M2R will set for you)

7. Account Status Codes — report only the following:

- 93 — Account assigned to internal or external collections

- 62 — Paid in full, was a collection account

- DF — Delete entire account due to confirmed fraud

- DA — Delete entire account (for reasons other than fraud – see below)

2. Consumer is deceased. (if no other associated consumer remains responsible for the account)

3. Accounts that are being paid by insurance or were paid in full through insurance (not by the consumer)

4. Debt Buyers must also delete accounts that have been forwarded or sold to another entity.

5. Third Party Collection Agencies must also delete accounts for the following reasons:

— Accounts that have been canceled and returned to the creditor

— Accounts of consumers who have filed petitions for Bankruptcy

6. Do not delete paid in full collection accounts - Account Status 62

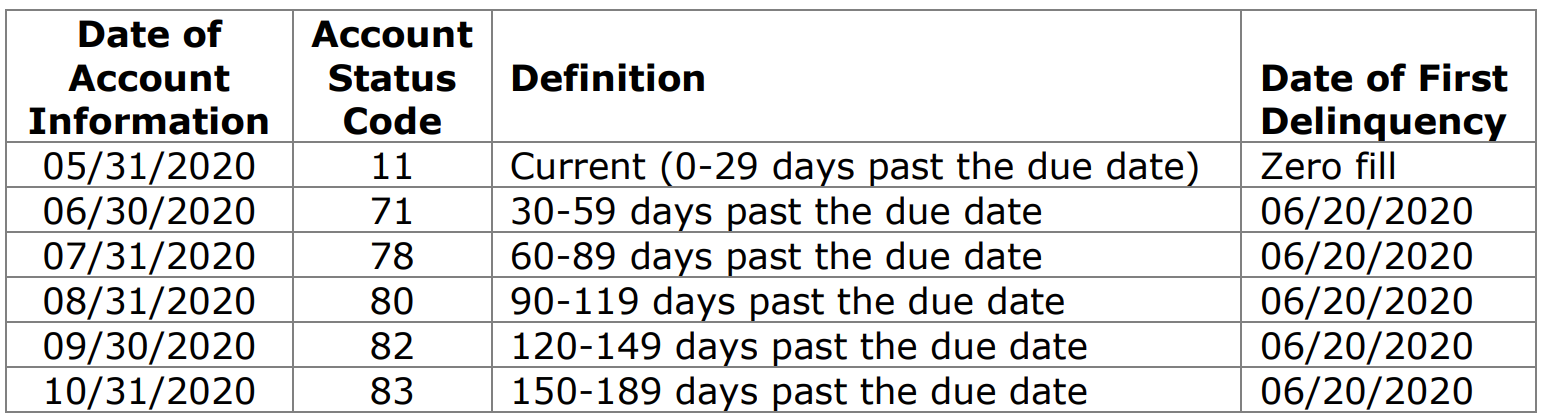

8. Date of First Delinquency — the date of the first delinquency with the original creditor that led to the account being sold or placed for collection.

Example:

Original Credit Grantor Reports

Example:

Original Credit Grantor Reports

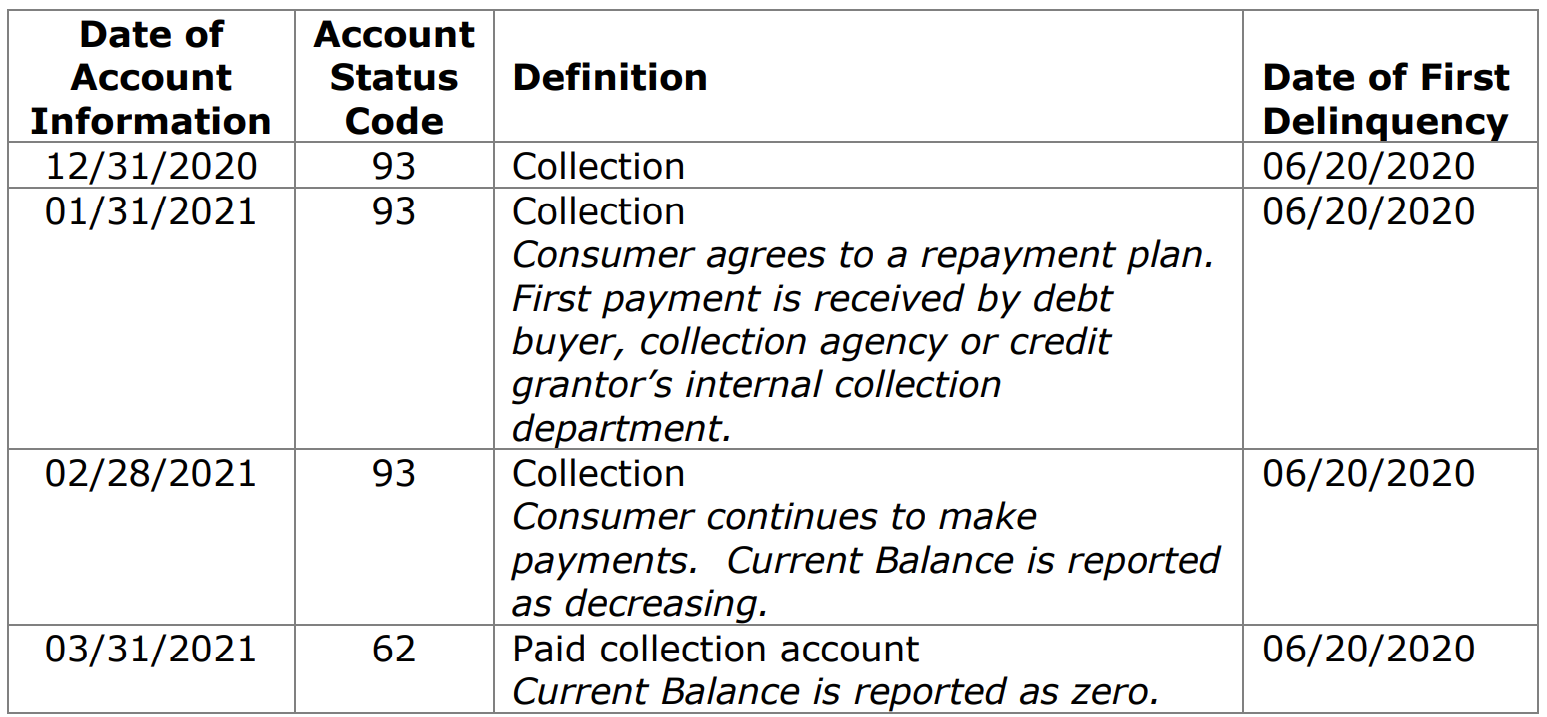

Then account is sold to debt buyer or assigned to collection agency.

Debt Buyer/Collection Agency Reports

Debt Buyer/Collection Agency Reports

Note: Date of First Delinquency does not change due to subsequent repayment agreements. When reporting returned checks, report the date the check was returned for insufficient funds. If not available, report the date of the check.

Effective March 31, 2004, the FCRA1 states that “provided that the consumer does not dispute the information, a person that furnishes information on a delinquent account that is placed for collection, charged for profit and loss, or subjected to any similar action, complies with this paragraph, if

Effective March 31, 2004, the FCRA1 states that “provided that the consumer does not dispute the information, a person that furnishes information on a delinquent account that is placed for collection, charged for profit and loss, or subjected to any similar action, complies with this paragraph, if

- (i) the person reports the same date of delinquency as that provided by the creditor to which the account was owed at the time at which the commencement of the delinquency occurred, if the creditor previously reported that date of delinquency to a consumer reporting agency;

- (ii) the creditor did not previously report the date of delinquency to a consumer reporting agency, and the person establishes and follows reasonable procedures to obtain the date of delinquency from the creditor or another reliable source and reports that date to a consumer reporting agency as the date of delinquency; or

- (iii) the creditor did not previously report the date of delinquency to a consumer reporting agency and the date of delinquency cannot be reasonably obtained as provided in clause (ii), the person establishes and follows reasonable procedures to ensure the date reported as the date of delinquency precedes the date on which the account is placed for collection, charged to profit or loss, or subjected to any similar action, and reports such date to the credit reporting agency.”

9. Special Comment Codes - Report Special Comment Codes in conjunction with Account Status Codes to further define the accounts.

10. Compliance Condition Codes – report the following codes, which are applicable to disputes under the Fair Debt Collection Practices Act (FDCPA) and to direct disputes under the Fair Credit Reporting Act (FCRA).

11. Current Balance — current balance amount, which may include fees and interest, depending on state and federal laws. If payments are made, the Balance amount should decrease accordingly.

12. Amount Past Due - may include fees and interest, depending on state and federal laws. If payments are made, the Amount Past Due should decrease accordingly.

13. Date of Last Payment – the date of the most recent payment made to the debt buyer or third-party collection agency.

14. Address – report the consumer’s full address as provided by the original creditor or a newer known address. If the consumer’s current address is unknown, report the consumer’s last known address and Address Indicator ‘N’ (not confirmed address). Note: An address found through skip tracing processes should be reported only when confirmed to be the address of the consumer you are reporting.

16. The following fields are not applicable and may be blank- or zero-filled:

For Debt Buyers only Account Type 0

17. Purchased Account From or Sold To. - If the name of the company from which the account was purchased is different from the Original Creditor name you can enter it for Other Creditor found under the Outside Agencies tab. If the original creditor and the name of the company from which the account was purchased, are the same do not fill out this information.

18. Consumer Information Indicator — used to specify that a consumer has filed bankruptcy or a consumer cannot be located. Note: Debt Buyers should not report accounts that were included in discharged/completed bankruptcies prior to purchasing.

- As an example, Special Comment AU (Account paid in full for less than the full balance) could be reported with Account Status Code 62

10. Compliance Condition Codes – report the following codes, which are applicable to disputes under the Fair Debt Collection Practices Act (FDCPA) and to direct disputes under the Fair Credit Reporting Act (FCRA).

- XB – Account information has been disputed by the consumer directly to the data furnisher under the FCRA; the data furnisher is conducting its investigation. Code XB should be reported for FDCPA disputes. Note: Code XB should no longer be reported after the investigation is completed; the XB should be removed by reporting the removal code or changed to another code.

- XC – FCRA direct dispute investigation completed – consumer disagrees with the results of the data furnisher’s investigation.

- XH – Account previously in dispute; the data furnisher has completed its investigation. (To be used for disputes under the FDCPA and for direct disputes under the FCRA)

- XR – Removes the most recently reported Compliance Condition Code

11. Current Balance — current balance amount, which may include fees and interest, depending on state and federal laws. If payments are made, the Balance amount should decrease accordingly.

12. Amount Past Due - may include fees and interest, depending on state and federal laws. If payments are made, the Amount Past Due should decrease accordingly.

13. Date of Last Payment – the date of the most recent payment made to the debt buyer or third-party collection agency.

14. Address – report the consumer’s full address as provided by the original creditor or a newer known address. If the consumer’s current address is unknown, report the consumer’s last known address and Address Indicator ‘N’ (not confirmed address). Note: An address found through skip tracing processes should be reported only when confirmed to be the address of the consumer you are reporting.

- The Affinity Name further identifies or provides linkage detail for the relationship of the original creditor to any connecting or supporting entities (e.g., ABC BANK THE HOME STORE).

- When reporting returned checks, report the name of the payee in the Original Creditor Name field

- Note that code 02 (Medical/Health Care) is used to identify an account as a medical collection debt in accordance with FCRA section 623.

16. The following fields are not applicable and may be blank- or zero-filled:

- Credit Limit – Leave Blank

- Terms Frequency – Leave Blank

- Scheduled Monthly Payment Amount – Leave Blank

- Payment Rating – Leave Blank

- Original Charge-off Amount – Leave Blank

For Debt Buyers only Account Type 0

17. Purchased Account From or Sold To. - If the name of the company from which the account was purchased is different from the Original Creditor name you can enter it for Other Creditor found under the Outside Agencies tab. If the original creditor and the name of the company from which the account was purchased, are the same do not fill out this information.

18. Consumer Information Indicator — used to specify that a consumer has filed bankruptcy or a consumer cannot be located. Note: Debt Buyers should not report accounts that were included in discharged/completed bankruptcies prior to purchasing.