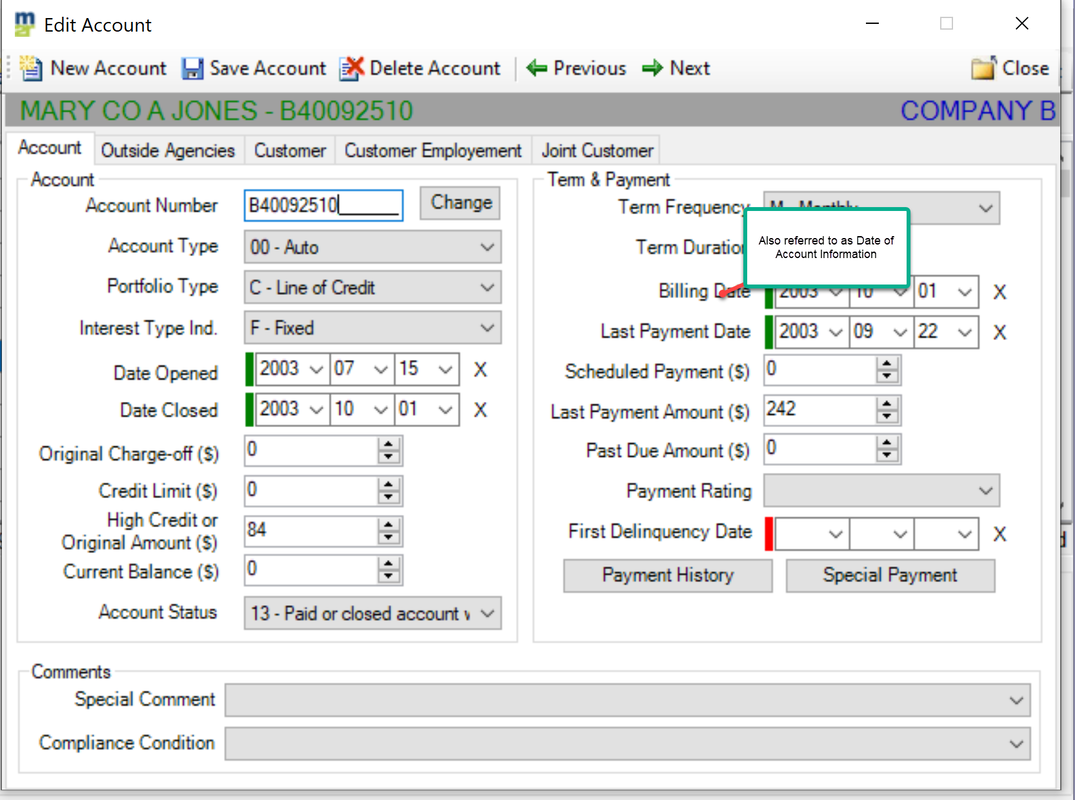

Date of Account Information also referred to as the Billing Date

Date that represents the current month’s reporting period. All account information, such as Account Status and Current Balance, must be reported as of the date in this field. Refer to the Glossary of Terms for a description and examples of “monthly reporting periods”.

For Account Status Codes 11, 71, 78, 80, 82-84, 88, 89, 93-97, DA and DF, report a date within the current month’s reporting period, as noted below:

· Cycle Reporters – Report the date of the current month’s billing cycle; i.e., reporting cycle. This method is preferred to facilitate accurate and timely reporting of account information.

· Monthly Reporters – Report the date within the current month’s reporting period that represents the most recent update to the account, such as mid-month (03/15/2023) or end of month (03/31/2023). The Date of Account Information may represent the consumer’s billing date as long as the date is within the current month’s reporting period. A historic or future date should not be reported.

For Account Status Codes 13 and 61–65 (paid statuses), report a date within the current month’s reporting period, as noted below:

· Portfolio Types I (Installment) and M (Mortgage) – Report the date paid.

· Portfolio Types C (Line of Credit) and R (Revolving) – Report the date the account was closed to further charges and has a zero balance. If the account was closed due to inactivity, then report the date within the current reporting period when the account was closed to further charges.

· Portfolio Type O (Open) – For Collection Agencies, Child Support Agencies, Debt Buyers, Residential Rental Companies, Student Loan Guarantors, the U.S. Department of Education (post-default loans), and Utility Companies, report the date paid. For credit card reporters, when the full balance amount is due each month, follow the guidance above for Portfolio Types C and R.

Notes: This date must not reflect a future date.

For accounts reported with bankruptcy Consumer Information Indicators, refer to Frequently Asked Questions 27 and 28 for guidelines on reporting the Date of Account Information.

For guidelines on reporting paid, closed or inactive accounts, refer to -

FAQs 39

FAQs 40

FAQs 41

For guidelines on reporting transferred or sold accounts, refer to FAQs 46, 47 & 48.

For guidelines on reporting accounts more than one time during a given monthly reporting period, refer to FAQ 61.