ACCOUNTS INCLUDED IN BANKRUPTCY

Question: Is there a preferred method of reporting when accounts are completely or partially reaffirmed in bankruptcy?

Answer: For accounts that are completely reaffirmed in bankruptcy, report the appropriate Account Status (Field 17A) and the Consumer Information Indicator R, which states “Reaffirmation of Debt”. The Consumer Information Indicator (Base Segment Field 38 and J1/J2 Segment Field 11) should be reported for each consumer who was involved in the bankruptcy. For accounts that are partially reaffirmed in bankruptcy, report a separate tradeline with a new Account Number for the portion of the account that is in repayment. For this new tradeline, report the Consumer Information Indicator R for each affected consumer, which states “Reaffirmation of Debt”, plus the appropriate Account Status. For that portion of the original tradeline which is still included in bankruptcy, report the appropriate Account Status (Field 17A), the appropriate Consumer Information Indicator (Base Segment Field 38 and J1/J2 Segment Field 11), and adjust the Current Balance (Field 21) accordingly.

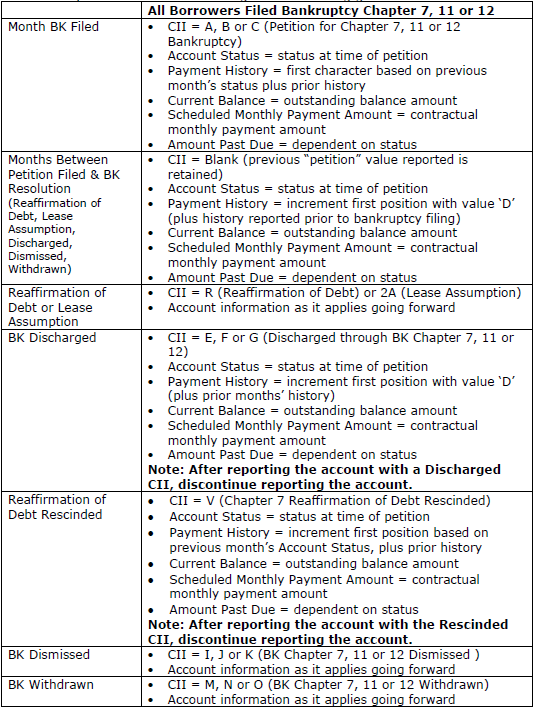

Question: How should an account be reported when all borrowers associated to the account filed Bankruptcy Chapter 7, 11 or 12?

Answer: Report the account according to the following guidelines:

Answer: For accounts that are completely reaffirmed in bankruptcy, report the appropriate Account Status (Field 17A) and the Consumer Information Indicator R, which states “Reaffirmation of Debt”. The Consumer Information Indicator (Base Segment Field 38 and J1/J2 Segment Field 11) should be reported for each consumer who was involved in the bankruptcy. For accounts that are partially reaffirmed in bankruptcy, report a separate tradeline with a new Account Number for the portion of the account that is in repayment. For this new tradeline, report the Consumer Information Indicator R for each affected consumer, which states “Reaffirmation of Debt”, plus the appropriate Account Status. For that portion of the original tradeline which is still included in bankruptcy, report the appropriate Account Status (Field 17A), the appropriate Consumer Information Indicator (Base Segment Field 38 and J1/J2 Segment Field 11), and adjust the Current Balance (Field 21) accordingly.

Question: How should an account be reported when all borrowers associated to the account filed Bankruptcy Chapter 7, 11 or 12?

Answer: Report the account according to the following guidelines:

CREDIT REPORTING RESOURCE GUIDE®

Copyright 2011 © Consumer Data Industry Association

Copyright 2011 © Consumer Data Industry Association

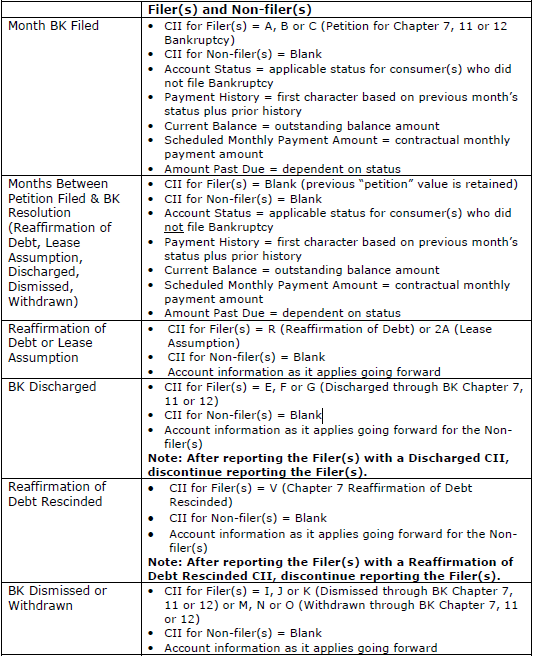

Question: How should a joint account be reported when one borrower filed Bankruptcy Chapter 7, 11 or 12 and the other borrower did not?

Answer: Report the account according to the following guidelines:

Answer: Report the account according to the following guidelines:

Note: The critical piece of displayable information for the bankruptcy consumer is the Consumer Information Indicator

CREDIT REPORTING RESOURCE GUIDE®

Copyright 2011 © Consumer Data Industry Association

CREDIT REPORTING RESOURCE GUIDE®

Copyright 2011 © Consumer Data Industry Association

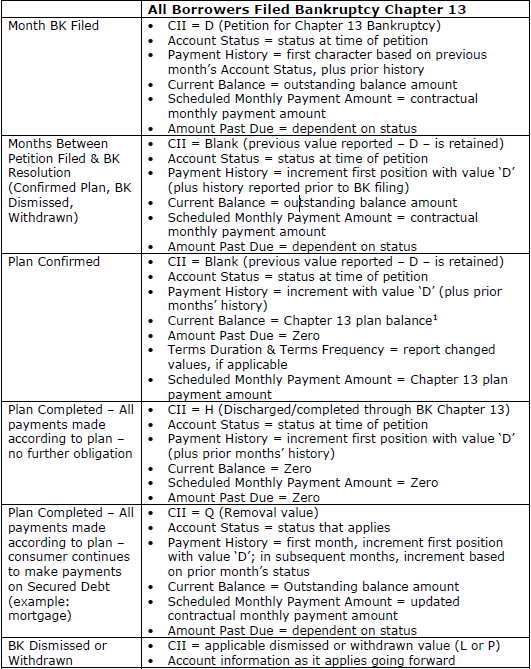

Question: How should an account be reported when all borrowers associated to the account filed Bankruptcy Chapter 13?

Answer: Report the account according to the following guidelines:

Answer: Report the account according to the following guidelines:

1 If the Chapter 13 plan balance amount is not clearly communicated to the lender, the lender should

consult with internal Legal to determine what amount to report in the Current Balance field.

CREDIT REPORTING RESOURCE GUIDE®

Copyright 2011 © Consumer Data Industry Association

consult with internal Legal to determine what amount to report in the Current Balance field.

CREDIT REPORTING RESOURCE GUIDE®

Copyright 2011 © Consumer Data Industry Association