Date of First Delinquency

Explanation and Examples of FCRA Compliance/Date of First Delinquency

Purpose: This date will be used by the consumer reporting agencies to determine when delinquent data is to be deleted, pursuant to the Fair Credit Reporting Act (FCRA).

How To Report:

The following are three step-by-step examples on how to report FCRA Compliance/Date of First Delinquency.

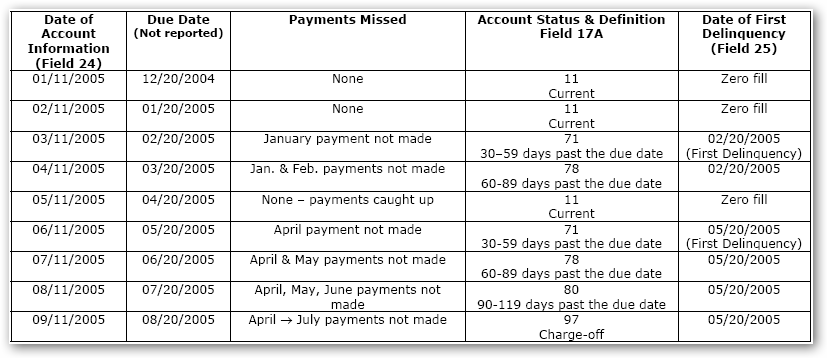

Example 1:Displays an account that goes delinquent to current and then goes delinquent again.

Purpose: This date will be used by the consumer reporting agencies to determine when delinquent data is to be deleted, pursuant to the Fair Credit Reporting Act (FCRA).

How To Report:

- For Account Status Codes 61-65, 71, 78, 80, 82-84, 88-89 and 93-97 - Report the date of the first delinquency that led to the status being reported. If a delinquent account becomes current, the Date of First Delinquency should be zero filled. Then if the account goes delinquent again, the Date of First Delinquency starts over with the new first delinquency date.

- For Account Status Codes 05 and 13, if the Payment Rating is 1-6, G or L, report the date of the first delinquency that led to the Payment Rating being reported.

- For Consumer Information Indicators A-H and Z (Bankruptcies), 1A (Personal Receivership) and V-Y (Reaffirmation of Debt Rescinded with Bankruptcy Chapters), if the account is current (Account Status Code 11 or Account Status Code 05 or 13 with Payment Rating 0), report the date of the bankruptcy/personal receivership notification. Even though the account is not delinquent, this date is required for purging purposes.

The following are three step-by-step examples on how to report FCRA Compliance/Date of First Delinquency.

Example 1:Displays an account that goes delinquent to current and then goes delinquent again.

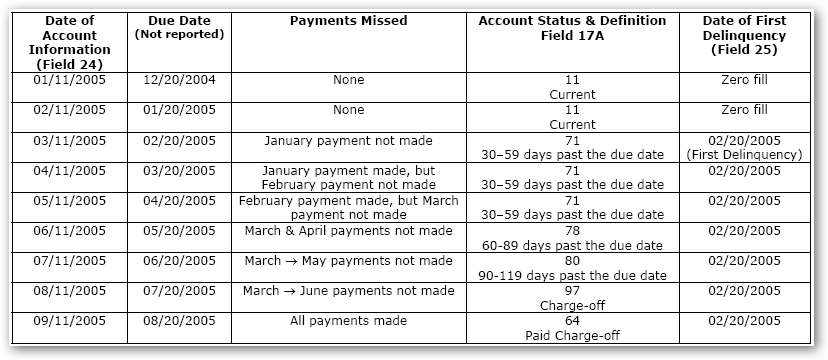

Example 2: Displays an account that goes delinquent and never returns to a current status.

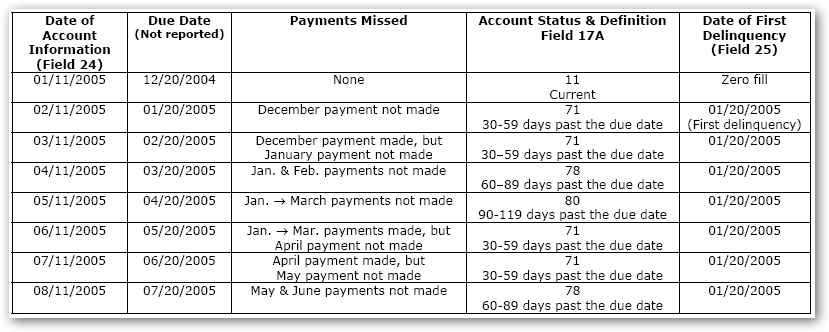

Example 3: Displays an account that has rolling delinquencies.