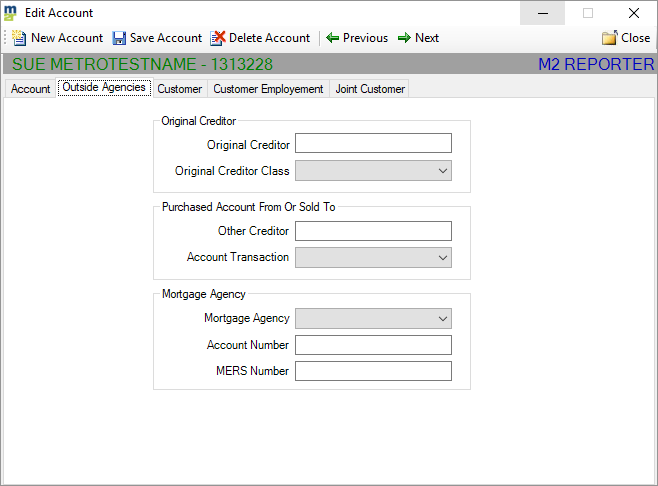

Edit Account - Outside Agencies

Original Creditor

Original Creditor - The Original Creditor must be present each time the account is reported if applicable.

Note: To assist with compliance of the Fair Credit Reporting Act, companies who report medical debts or returned checks for medical purposes must report Creditor Classification ‘02’ to indicate ‘Medical/Health Care’. The actual name of the original creditor should continue to be reported in the Original Creditor Name

Original Creditor Classification - Contains a code indicating a general type of business for the Original Creditor Name. Values available:

- This field is required for collection agencies, debt buyers and check guarantee companies.

- This field may also be reported by student loan guaranty agencies, the U.S. Department of Education, and the U.S. Treasury.

- The purpose of reporting the original creditor name is to help consumers identify the source of accounts when they appear on credit reports. Without the original creditor names, consumers may not know what the accounts represent.

- Some state laws and CDIA policy stipulate that the original client/creditor must be identified. Federal law stipulates that the name of the payee must be identified when reporting returned checks.

Note: To assist with compliance of the Fair Credit Reporting Act, companies who report medical debts or returned checks for medical purposes must report Creditor Classification ‘02’ to indicate ‘Medical/Health Care’. The actual name of the original creditor should continue to be reported in the Original Creditor Name

Original Creditor Classification - Contains a code indicating a general type of business for the Original Creditor Name. Values available:

- 01 Retail

- 02 Medical/Health Care Required when reporting medical debts and returned checks from providers of medical services, products or devices

- 03 Oil Company

- 04 Government

- 05 Personal Services

- 06 Insurance

- 07 Educational

- 08 Banking

- 09 Rental/Leasing

- 10 Utilities

- 11 Cable/Cellular

- 12 Financial - (other non-banking financial institutions)

- 13 Credit Union

- 14 Automotive

- 15 Check Guarantee

Purchased Account From or Sold To

Other Creditor - This option may be used to report the name of the company from which the portfolio or partial portfolio was purchased or the name of the company to which the portfolio or partial portfolio was sold.

Account Transaction - Contains a code representing the type of information being reported. Values available:

Note: Account Purchased information should not be reported by collection agencies, debt purchasers, factoring companies, check guarantee companies, student loan guaranty agencies and the U.S. Department of Education.

Account Transaction - Contains a code representing the type of information being reported. Values available:

- 1 Portfolio Purchased from Name

- 2 Sold Name

- 9 Remove Previously Reported Information

Note: Account Purchased information should not be reported by collection agencies, debt purchasers, factoring companies, check guarantee companies, student loan guaranty agencies and the U.S. Department of Education.

Mortgage Agency - This option is used to indicate a secondary marketing agency's interest in a loan by providing the applicable account number as assigned by the secondary marketing agency. It is also used to report the Mortgage Identification Number (MIN), when available

Mortgage Agency - Contains a code indicating which secondary marketing agency has interest in this loan. Values available:

Account Number - Contains the account number as assigned by the secondary marketing agency. Do not include embedded blanks or special characters.

Note: If the Mortgage Agency is 00, Agency Identifier not applicable, this field should be blank .

MERS Number (or MIN) - Contains the Mortgage Identification Number assigned to a mortgage loan. The MIN indicates that the loan is registered with the Mortgage Electronic Registration Systems, Inc. (MERS), the electronic registry for tracking the ownership of mortgage rights. For more information, see http://www.mersinc.org

- 00 Agency Identifier not applicable (Used when reporting MIN only)

- 01 Fannie Mae

- 02 Freddie Mac

Account Number - Contains the account number as assigned by the secondary marketing agency. Do not include embedded blanks or special characters.

Note: If the Mortgage Agency is 00, Agency Identifier not applicable, this field should be blank .

MERS Number (or MIN) - Contains the Mortgage Identification Number assigned to a mortgage loan. The MIN indicates that the loan is registered with the Mortgage Electronic Registration Systems, Inc. (MERS), the electronic registry for tracking the ownership of mortgage rights. For more information, see http://www.mersinc.org